Media Mentions

Managers Hit Roadblocks Expanding Data Analytics to Institutional Distribution

by: Tony Rifilato , FundFire

December 1, 2023

Managers are looking at the retail space on how to best incorporate data to drive distribution and marketing efforts.

Asset managers are leaning more heavily on data and technology to bolster sales and marketing. But firms are at the mercy of limited data sets in the institutional channel, and some managers have not developed a cohesive plan to incorporate data, panelists said at the Sales and Marketing Enablement Forum last month.

Asset managers are stepping up their data integration efforts in a bid to boost cost efficiencies and conduct more targeted outreach.

T. Rowe Price is wrapping up a three-year project to upgrade its data system, Theresa Brennan, head of sales enablement in the firm’s global sales management organization, said during the forum.

The firm announced in 2018 that it was integrating its legacy systems with Salesforce’s cloud-based customer relationship software to build an integrated platform. The firm is building a “robust analytics program that covers all of our global distribution businesses,” Brennan said.

“The availability of data has changed the approach to sales and service, along with the industry forces,” she said.

Thornburg Investment Management, meanwhile, is working to coordinate “data intelligence, CRM and sales execution strategies” across its sales and marketing teams, said panelist Leah Swanson, the firm’s co-head of sales and marketing enablement. The firm is also assessing whether the firm should use cloud computing platform Snowflake.

Thornburg also uses third-party data providers such as SS&C, its internal data and Morgan Stanley and other broker-dealers’ data packs. Those packs can cost an average of $660,000 for wirehouse data, according to Cerulli Associates. The Santa-Fe, New Mexico-based firm, however, is not currently incorporating data on the institutional side for client segmentation efforts, Swanson said.

Managers are having better luck in the retail channel, as they can buy large prospect lists and glean information on what products are gaining traction with advisors from wirehouses and broker-dealers.

“On the institutional side, because it is a much smaller audience, there is less data available, said Loren Fox, director of research at Fuse Research Network, during the forum, which is commonly called SME. “It [also] tends to be a little bit behind the retail side in terms of their progress on taking data and leveraging it for sales and marketing purposes.”

Institutional sales cycles tend to be longer than retail, which makes it more challenging to use data or “at least to see an impact in a quick timeframe,” Fox told FundFire.

One reason the institutional channel did not embrace data as quickly as the retail side in years past is because institutional sales teams had largely been able to get by with the “few hundred contacts on Excel spreadsheets, as opposed to having it in a [customer relationship management] system,” he said.

But as managers face declining profit margins, fee-compression and asset owners who want to work with fewer managers, senior executives are taking their data distribution strategies more seriously.

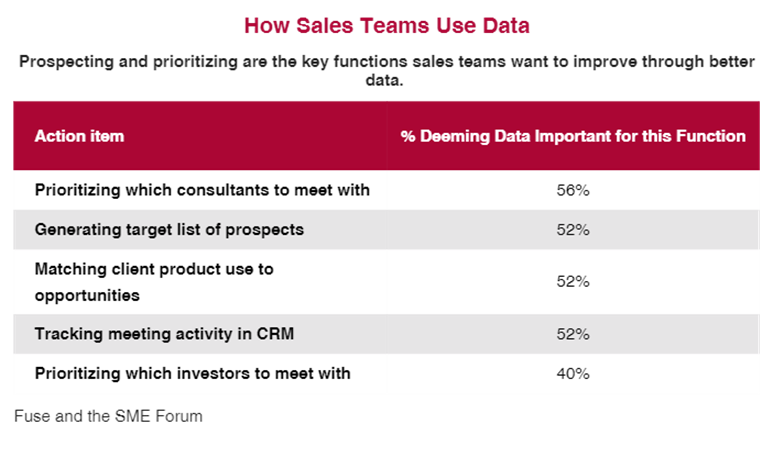

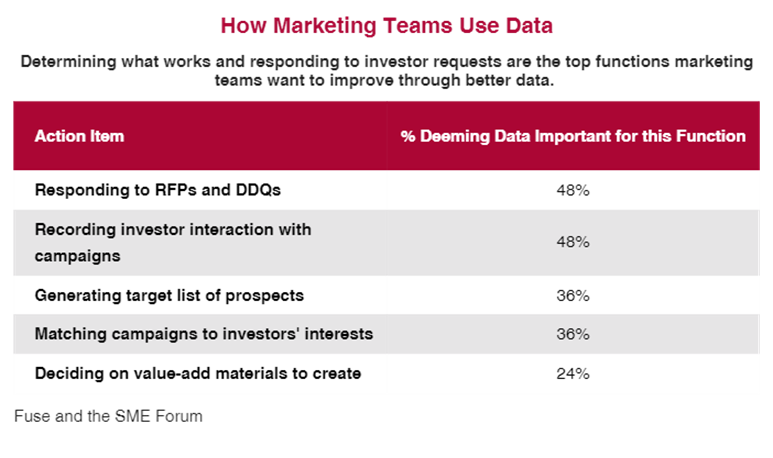

But just 32% of asset managers polled said they implemented a firmwide strategy to have data aid decision-making this year, according to a recent joint survey of 25 asset managers by Fuse and the SME Forum. This is up from 27% in 2021.

Twenty-four percent said their data strategies are not unified across divisions, and 28% indicated that they only apply a data approach “tactically,” instead of strategically.

A firmwide strategy is key, as marketing data could prove useful to sales teams, Fox said. “Marketing should really be seen, not just as a support function, but really as a strategic partner in the business.”

Firms are demanding more information on what products and strategies are gaining the most traction with institutional investor clients as well as fund flows into various products and vehicles, Fox said.

The key issue is how to best integrate the disparate data sets into a customer relationship management, or CRM, system, he added. “How can you then serve up useful insights from the information so that your marketing and sales teams know or have some guidance on what kind of actions to take.”

Data on alternative investments is also challenging when it comes to reconciling and determining compensation, said panelist Pat Frame, a divisional sales manager at J.P. Morgan Asset Management.

Despite the hurdles, as more firms integrate their CRM systems, it “will help the institutional side learn from the retail side,” Fox said.

Indeed, institutional asset managers are aggressively hiring for CRM specialists to build out data analysis capabilities over the next 12 months, he added.

“These are the top roles … you see a lot of asset managers are seeking more focus in CRM development,” he said.

FundFire is a copyrighted publication. FundFire has agreed to make available its content for the sole use of the employees of the subscriber company. Accordingly, it is a violation of the copyright law for anyone to duplicate the content of FundFire for the use of any person, other than the employees of the subscriber company.